Get this template

Travel_Xp

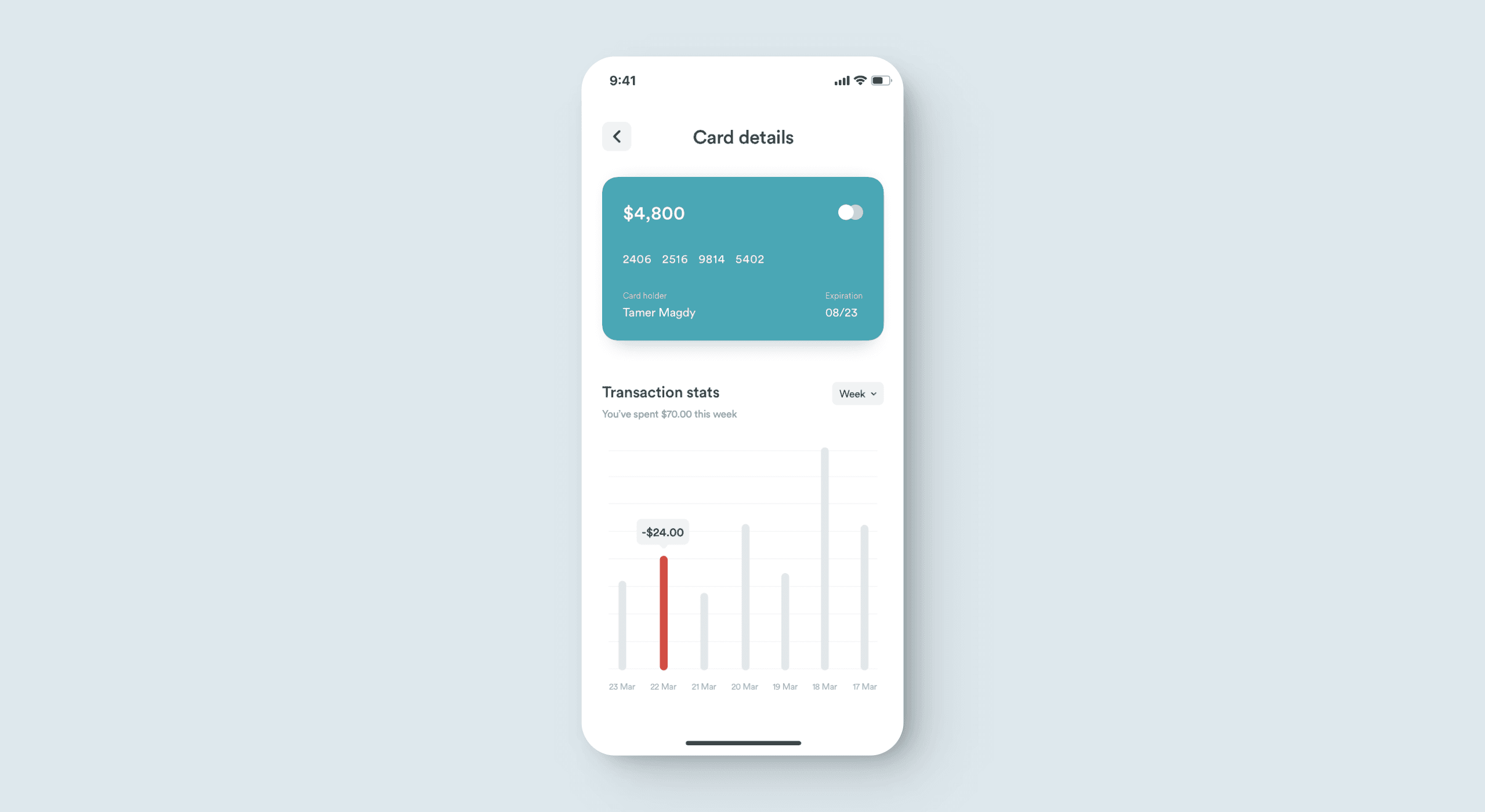

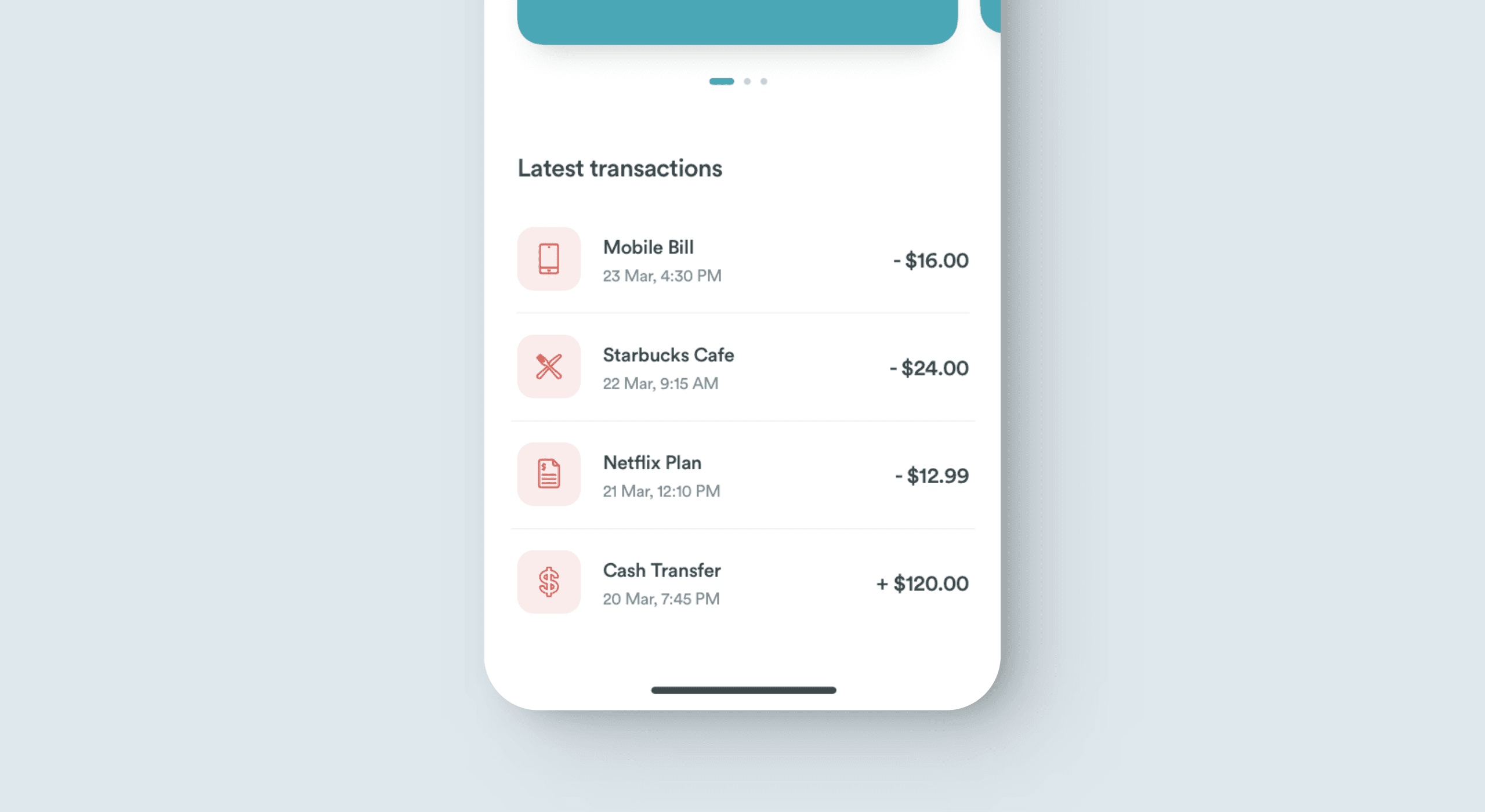

An app that is a powerful tool designed to help users manage their financial responsibilities effectively. The app offers a range of features, including credit card tracking, transaction management, subscription and bill management, expense control, and budgeting tools.

The challenge for the personal finance mobile application was to provide users with a comprehensive solution for tracking their credit cards, managing their transactions, subscriptions, bills, and controlling their expenses. With numerous financial responsibilities, users needed a centralized platform that could help them easily manage their finances, avoid unnecessary expenses, and achieve their financial goals. The challenge was to create a user-friendly, intuitive, and feature-rich mobile application that could meet these diverse financial needs and provide users with a seamless experience.

— USER RESEARCH

To uncover pain points and optimise the new design, I conducted a comprehensive user research,

which included task completion times analysis, user surveys, and in-depth interviews with stakeholders. This multi-faceted approach revealed critical inefficiencies in the existing system and established a clear baseline for user-centered improvements.

The app's user-friendly interface and intuitive design make it easy for users to track their financial activities in real-time, view their transaction history, and receive alerts for upcoming bills and payments. Users can also set budget goals and receive personalized financial advice based on their spending patterns, helping them stay on track and achieve their financial objectives.

Moreover, the app's advanced security features, including two-factor authentication, biometric login, and data encryption, ensure that users' financial data is secure and protected. The app also integrates with popular financial institutions, allowing users to view their account balances, transaction history, and credit scores in one place.

The app's success was due in part to its user-centric design process. The team conducted extensive research and user testing to ensure that the app met users' needs and preferences, resulting in a highly effective and user-friendly platform.

The app's range of features, including credit card tracking, transaction management, subscription and bill management, expense control, and budgeting tools, provided users with a comprehensive financial management solution. This helped users to better control their spending, reduce unnecessary expenses, and achieve their financial goals.